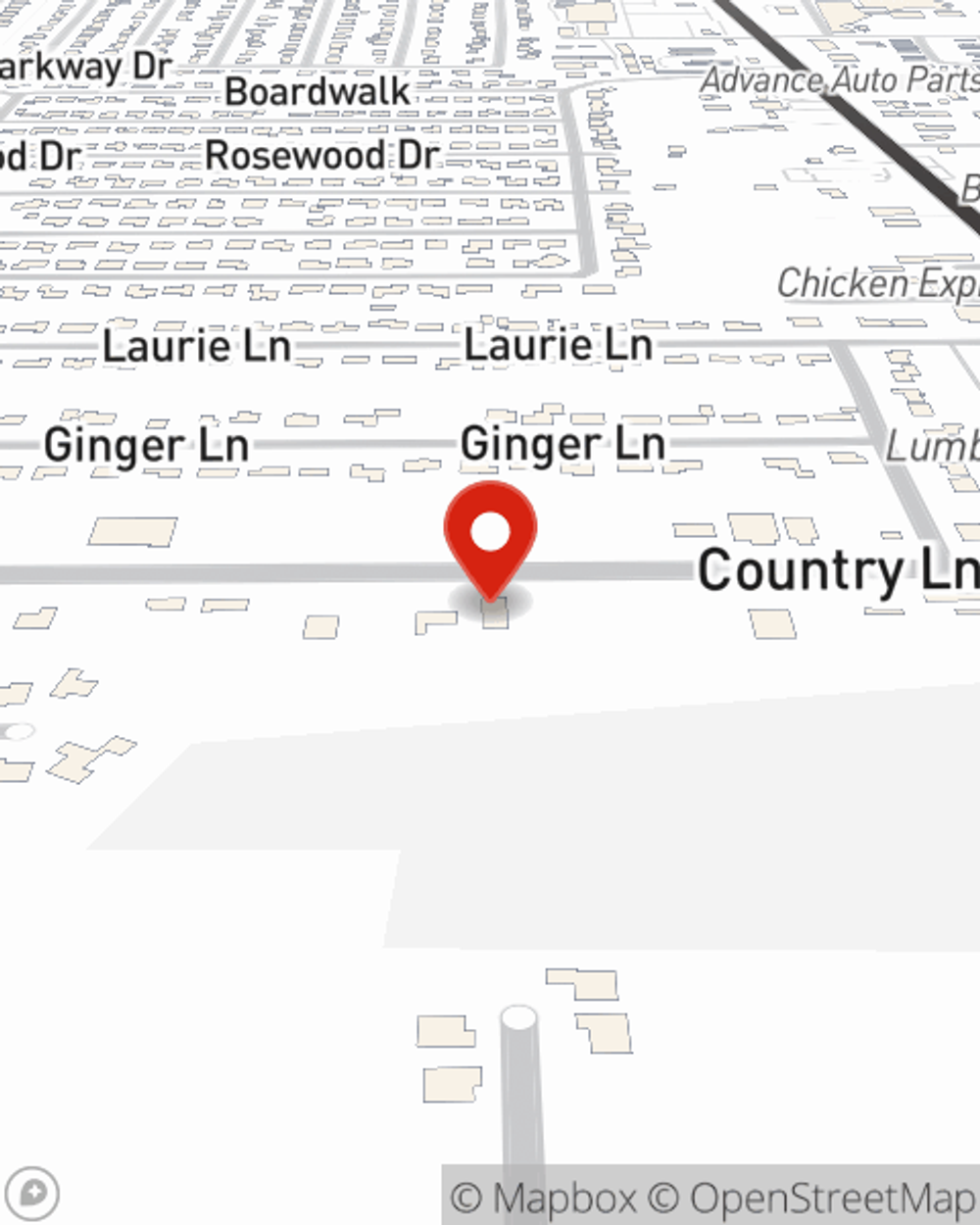

Business Insurance in and around Lumberton

One of the top small business insurance companies in Lumberton, and beyond.

Insure your business, intentionally

Help Protect Your Business With State Farm.

Running a small business comes with a unique set of wins and losses. You shouldn't have to face those alone. Aside from just those who care for you, let State Farm be part of your line of support through insurance options including business continuity plans, extra liability coverage and a surety or fidelity bond, among others.

One of the top small business insurance companies in Lumberton, and beyond.

Insure your business, intentionally

Protect Your Business With State Farm

Whether you own a veterinarian, a barber shop or a beauty salon, State Farm is here to help. Aside from excellent service all around, you can customize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Call Keith Wolfe today, and let's get down to business.

Simple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Keith Wolfe

State Farm® Insurance AgentSimple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.